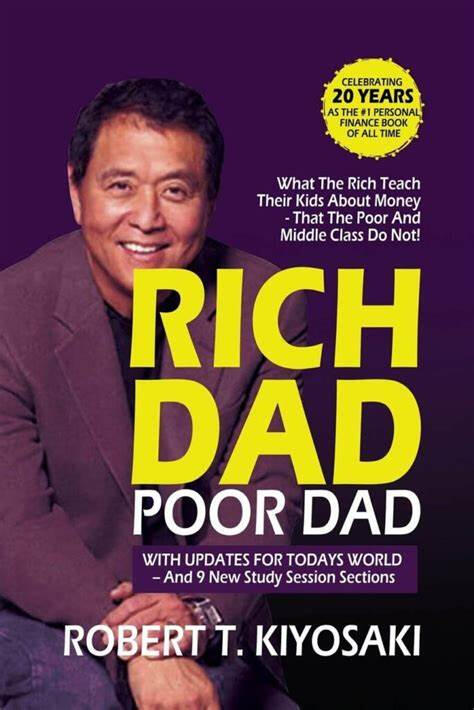

Rich Dad Poor Dad

Rich Dad Poor Dad is one of the most influential personal finance books ever written. It challenges conventional beliefs about money, education, and financial success. Kiyosaki presents a unique perspective through the contrasting philosophies of his "Rich Dad" (his best friend's father, a successful entrepreneur) and "Poor Dad" (his biological father, a well-educated government employee). The book is essential for anyone looking to escape the rat race, achieve financial freedom, and build generational wealth.

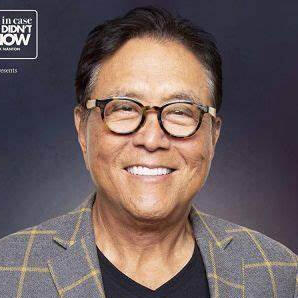

Robert T. Kiyosaki

Robert Kiyosaki is a businessman, investor, and educator in financial literacy. He founded the Rich Dad Company and created the Cashflow board game. His teachings focus on empowering individuals to achieve financial freedom through entrepreneurship and smart investing.

Short Summary

Chapter 1: The Two Dads & Their Financial Advice

Young Robert grows up with two father figures—his highly educated but financially struggling real father, and his best friend's wealthy, self-made father. Their contrasting advice shapes his financial mindset.

Chapter 2: The First Lesson - Money Mindset Matters

Robert learns from Rich Dad that working for money is a trap. Instead, he must make money work for him through smart investing.

Chapter 3: Understanding Assets and Liabilities

Through real-life experiences, Robert discovers the importance of owning assets like real estate and stocks rather than accumulating consumer debt.

Chapter 4: The Leap to Financial Freedom

After applying these lessons, Robert builds businesses and investments that generate passive income, freeing him from the traditional job system.

Chapter 5: How You Can Apply These Lessons

The book ends with practical steps for readers to escape the Rat Race and begin their journey toward financial independence.

Develop financial literacy – Learn how money works, how to read financial statements, and distinguish between assets and liabilities.

Focus on acquiring income-generating assets – Invest in rental properties, stocks, or businesses that provide cash flow.

Start a side hustle – Create additional income streams beyond your job.

Reduce debt and unnecessary expenses – Cut liabilities that do not contribute to wealth building.

Surround yourself with financially successful people – Learn from mentors and experts in wealth-building strategies.

Take calculated risks – Don’t be afraid to invest and take entrepreneurial steps toward financial independence.

Main Ideas - Key Concepts Explained Clearly

✅ 1. The Importance of Financial Education

Concept: Schools teach us to be employees, not entrepreneurs or investors. Understanding money is more important than simply working for it.

Example: In 1929, the Great Depression wiped out millions of people’s wealth, but those with financial literacy managed to capitalize on opportunities and rebuild fortunes.

✅ 2. Assets vs. Liabilities

Concept: The rich acquire assets that generate income, while the poor and middle class accumulate liabilities that drain their finances.

Example: A house is often considered an asset, but if it doesn’t generate income (e.g., rental property), it is a liability. Instead, investing in real estate that provides passive income builds wealth.

✅ 3. The Rat Race & The Cashflow Quadrant

Concept: Most people work for money instead of making money work for them. They remain stuck in the "Rat Race"—a cycle of earning, spending, and debt.

Example: Many employees live paycheck to paycheck, relying on salary increases instead of creating passive income streams.

✅ 4. Entrepreneurship & Investing

Concept: Building businesses and investing are key to financial freedom. Employees have limited income potential, while business owners and investors enjoy exponential wealth growth.Example: Warren Buffett, one of the world’s richest men, built his fortune by investing wisely rather than relying on a salary.

Practical Applications - How to Implement These Lessons Immediately

Start tracking your financial statements (Identify your assets and liabilities).

Invest in financial education (Read books, take courses, and follow financial mentors).

Create passive income streams (Start a side business, invest in rental properties or dividend stocks).

Reduce liabilities (Cut unnecessary expenses and pay off debts).

Shift from employee to investor mindset (Focus on wealth-building activities instead of job security).

Briffio

Discover the Best Short summaries on briffio.com

© Briffio. All rights reserved.